Health Insurance and the Mid-Market

Mid-market company size is somewhat of an amorphous term, usually defined by revenue or employee size. Although there is no hard and fast rule, mid-market companies generally are between $25m-$250m in annual revenues and between 50?500 employees.

In terms of Health Insurance, 50 employees is somewhat of a magic number as it is the point when insurance carriers look at the company-specific claim history and have less regulatory pricing and disclosure restrictions to deal with. Companies with less than 50 employees are typically put in a ?community pool? and have less control over rate increases.

?WTIA Health Trust and the Mid -Market

The WTIA?Health Trust?is a bona fide association health plan (AHP) that gives small companies (<50 employees) some of the same pricing benefits as large companies. The WTIA?Health Trust has 13 plan options that range from very rich to basic. All 13 plan options are considered ?fully insured? plan types. The WTIA?Health Trust?is extremely valuable to our small company members, literally saving them thousands of dollars per year while enabling them to be more competitive from a recruitment standpoint.

Unfortunately, the WTIA?Health Trust?is not the ideal solution for ?mid-market? companies, especially as company headcount approaches more than 100 employees.

Health Insurance ? How the ?System? works & Rules of Thumb

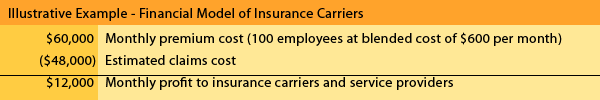

Most insurance carriers shoot for a claims loss ratio between 80%-85%. Said another way, they are targeting a 15%-20% profit on the premiums they take in. This profit goes directly to the insurance carriers and a portion of the proceeds are used to compensate insurance brokers and other service providers. Consider the following example:

This is a very simple example to illustrate how the system works. It also provides some nice ?material? rules of thumbs:

? 600 per month per employee is a reasonable starting point when forecasting health care costs for mid-market companies. This is blended cost between single employees and those with families or dependents. This concept is referred to as PEPM (per employee premium monthly).

? 100 employee company yields around ~$60k cost per month in health insurance. Again, this is a starting point for developing a general cost estimate.

? Insurance/service provider companies make ~$12k per month of a 100 person company

Why ?Self-insurance? mathematically makes sense for the Mid Market

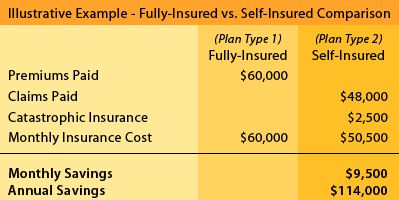

Although the WTIA Health Trust has thirteen (13) plan options, it only has 1 real plan type-fully insured. Fully insured is the most traditional plan type with the carrier being responsible for almost of the claims and the employer being responsible for paying monthly premiums. There are; however, other plan types that are available with the ?self-insured? plan type being the next most common for mid-market companies. Using the same example above you can see why the self-insured plan type is attractive:

It is clear from the above example why self-insurance is so popular but also risky. Rather than paying premium costs the employer bears the ?claim risk?. Over time and with a large enough employee base this should theoretically result in massive savings as the employer will effectively eliminate the 15%-20% profit paid to outside parties. Much like gambling where the house should win over a large sample size, self -insurance should result in cheaper health insurance costs for employers over time.

The theoretical concept explained above is why the ?self-insurance? plan type is highly popular with mid-market companies. The key exercise that mid-market companies must go through in evaluating self?insurance is the underlying health of its employee base. If there are known medical conditions and/or a significant non-recurring claims expected, self?insurance is probably not the right solution.

Health Savings Accounts and why they are so popular

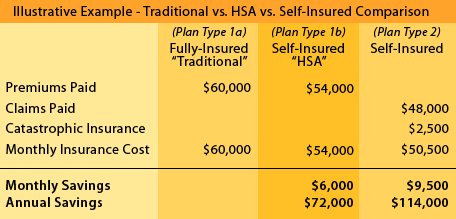

Health Savings Accounts (HSA?s) is a fully insured plan type; however, the deductible is much higher than in a traditional plan option. This factor keeps monthly premium costs down as there is less incentive for employees to use the health care system when they have a high deductible to cover. HSA?s usually allow for a free annual preventive visit (physical) and also have properties of a traditional IRA making it another investment vehicle for employees.

More employers have been selecting Health Savings plan options than ever before because it offers the risk protection of a fully insured plan with the cheaper costs associated with a self-insured plan. It also moves the responsibility to the employee and gets them active in the management of their health. Using the same example above, I have constructed a comparison for a generic 100 person tech company:

As you can see from the example above, the ?HSA offers a nice ?intermediate? option as it allows the employer to manage risk while realizing sizable savings.

WTIA health insurance options for large groups (Including Mid-Market)

The WTIA has traditionally focused on small group health insurance offerings (<50 employees) for its members. Recently, however, the WTIA?has been exploring health insurance offerings targeted at large groups (>50 employees) which certainly include mid-market companies. Specifically, the WTIA?has been working with its insurance carrier partner, Regence Blue Shield, to accomplish the following:

1) Develop a suite of insurance products (plan types) and services specifically tailored to member companies with 50 or more employees. This would include fully insured and self-insured (ASO) plan types.

2) Leverage the healthcare purchasing power of the technology industry in Washington State to deliver significant savings to member companies.

3) Offer competitively priced insurance products that are bundled with a WTIA?membership to provide access to our community and resource base.

We expect to have a large group offering in place by the summer of FY 2013.

Why should all this matter to you?

Washington law provides a way for small businesses to pool their purchasing power to buy health insurance through trade associations and member-governed groups, like the WTIA. These plans, called Association Health Plans or Affinity Group Plans, allow small employers the advantage of large group rates for health insurance. The WTIA?Health Trust?is just one of the many ways your membership can help you curb business costs while providing more value to your employees. But what happens when a small employer moves along in the business life cycle and becomes a mid-market employer? What happens when they become large? WTIA?is working hard to make sure there are scalable options in place that serve our member base in all stages of the business life-cycle.

With nationalized healthcare implementing in the near future, it?s important to understand not only what?s available, but what the very best option is for your unique business situation. What may be great for some, might not be the most cost effective for others.

For more information on what your options are, contact your WTIA?member representative.

Mike Monroe

Vice President of Operations & Finance

Washington Technology Industry Association

Source: http://wtiablog.org/2013/01/02/health-insurance-for-early-stage-mid-market-companies/

oregon ducks oregon ducks rob gronkowski Coughing eddie murphy Stephanie Bongiovi stanford football

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.